|

By Amy Joi O'Donoghue, Deseret News Published: Saturday, March 26 2016 4:00 p.m. MDT SALT LAKE CITY — State and federal geologists say there's enough coal in the state to keep the coal mining industry running for 55 years, but few think that is a realistic projection given environmental pressure, increasing regulations and the pace of shrinking national demand.

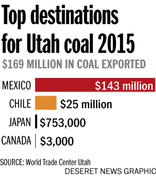

Utah, like other U.S. coal-producing states, has turned its sights on ramping up foreign exports to meet demands in other countries, particularly to developing nations hungry to plug into a cheap form of electricity. The move is controversial from a philosophical and environmental standpoint among opponents who decry the public health impacts of fossil fuels. But coal-producing communities say it is a matter of their survival. "Nobody likes to relocate to a ghost town," said Carbon County Commissioner Jae Potter. "This buys us some time." Potter's Carbon County, along with Emery, Sanpete and Sevier counties, are behind the successful push to invest $53 million for 49 percent access in a planned bulk terminal off San Francisco Bay at Oakland. The covered terminal would be built on land that once housed an Army base and is now owned by Oakland City. No money has exchanged hands in the proposal — which still requires another $200 million to become a fiscal reality — but the financing mechanism approved by the Utah Legislature this month and endorsed by Gov. Gary Herbert stoked howls of protest from critics who described it in unsavory terms like "scheme," "shell game," or even "money laundering." The funding mechanism established in Senate Majority Whip Stuart Adams'SB246 involves a three-way transfer of money. This is how it will work. In the fiscal year that begins July 1, $26 million will be taken from a transportation sales tax fund and put into an enterprise fund for the export terminal. The same amount in mineral lease revenue — the money earned from oil and gas extraction and industries like coal mining and then returned to originating counties — will be transferred from the Community Impact Fund to a newly created account to spend on transportation projects. The $26 million already set aside at the Community Impact Fund in a long-term infrastructure account will be repaid by the counties via a 30-year-loan at 2 percent interest, which is the fund's standard loan and repayment terms. The same transfers happen in fiscal year 2018 for $27 million. "There is no risk to taxpayers' money," Adams said. "If I give you a $10 bill to hold on to for 10 minutes, and then exchange it with you for two $5 bills — all that has happened is the money has been changed." Adams and the Community Impact Fund Board Chairman Keith Heaton said swapping funds to pay for community needs when there may be federal strings or limitations attached is not an unusual state practice, especially for transportation projects. Critics questioned the use of community impact funds in an out-of-state project, but Potter said that is why they ran the measure by lawmakers' scrutiny — for public accountability and legal review by the Legislative Office of General Counsel. "Someone told us if this was such a good idea, we should run it through the Legislature," he said. For the counties involved, it remains a local investment, he said. "That has what has been the big lie, that this is a waste of taxpayer dollars," Potter said. "This is a trading of dollars that have already been set aside and paid to the counties because of mineral development." Coal-fired opposition Some California politicians, the Oakland mayor, the Sierra Club Beyond Coal Campaign and the "Keep it in the Ground," movement are trying to block Utah's planned export of coal. Earthjustice filed a lawsuit, and then withdrew it with a right to re-file as the city conducts a public health and safety review of the proposed terminal and rail shipments. Hundreds of people packed an Oakland City-hosted meeting last fall, including opponents to the proposal and project developers who say the $250 million project will support an annual payroll of $120 million and provide transport for 20 different bulk commodities. Sen. Loni Hancock, D-California, is running several bills which aim to stop the export of coal from what some say would be the West Coast's largest coal export facility if built. They are scheduled to be heard in a committee hearing in early April before the California Legislature. Tapping local sentiment, the Sierra Club in the Bay Area did its own poll that showed 76 percent of Oakland voters are opposed to exporting coal from San Francisco Bay. Bill Corcoran, Western director of the Sierra Club's Beyond Coal Campaign, said the railway transport of coal to the export terminal poses an immediate public health impact, adding more toxins to an area already "hammered" by industrial pollution. The Sierra Club, in its campaign to stop the terminal, shows uncovered coal cars on its website and describes how toxic coal dust would result in more hospital trips for children with asthma. The trains, however, would be covered and unloaded in a covered terminal that its developer, Terminal Logistic Solutions, said is designed to meet or exceed all California state environmental regulations. The project, the company adds, has to meet more than 660 mitigation mandates and conditions of approval with the city and the Port of Oakland. But Corcoran said the export of Utah coal from California is fundamentally wrong. "California has positioned itself as a leader in addressing climate change and Oakland as a city is committed to address climate change," he said. The idea that the "dirtiest fuel we use to produce electricity," would be shipped out of Oakland is an affront to the city's own aspirations and to the state more broadly, he said. On the Utah front, the fight to stop the terminal includes Tim Wagner, a former Sierra Club staffer who now serves as executive director of the Utah Physicians for a Healthy Environment. He lobbied against Adams' bill on Capitol Hill, arguing among other things that it is a bad investment. "It makes no financial sense whatsoever. Coal markets all across the planet are in a complete decline, with no sign of them coming back," he said. "I don't care if the Utah Legislature wants to throw $53 billion at this proposal, it is not going to revive the coal industry in this state." A 2014 report on Utah coal issued by the state's Rural Planning Group predicts that for coal to thrive, a scenario has to play out that includes slowing advancement in renewable energy technologies and some sort of major disruptive and unfortunate accidents when it comes to the production and use of the cleaner natural gas. The market considers coal to be the lowest risk, highest return energy source and a major catastrophic event — such as war — keeps coal as an indispensable power source. Those conditions are a tall order and Utah's coal country is facing very real and dramatic reductions of domestic demand. In Utah it is projected to be at 28 percent, caused by the 2015 closure of the Carbon power plant and the transition of the Intermountain Power Plant in Millard County moving to natural gas by 2027. "That leaves us with a cliff coming that says, 'Hey, what do we do?" Potter said. Why the port? The report notes that there are three major hurdles Utah's coal industry needs to overcome in the years ahead and key among them is limited port capacity that constrains selling coal to markets abroad. Last year, Utah exported nearly $169 million worth of coal to four foreign countries. Mexico was the top destination, receiving $143 million worth of coal. Derek Miller, president and chief executive officer of World Trade Center Utah, said transportation is half the battle in getting Utah products to foreign markets, and the other half is port access. "I think it will be a significant benefit to have these rights at this port," Miller said. The terminal would also provide a route for Utah grown hay, as well as salt and soda ash. Miller said those other commodities don't have the same environmental constraints as Utah's coal, which he predicts may see an increased demand globally because it burns more efficiently and has a low sulfur and low mercury content. "As you see environmental standards get higher in China and other markets, our coal would have a competitive advantage under those circumstances." Coal critics cite China's sputtering demand for coal as the death knell for the industry, but the International Energy Agency predicts slowed, but continued growth in coal demand through at least 2020. Jason Hayes, associate director of the American Coal Council, said coal — despite its critics — remains the cheapest form of reliable electricity and produces far fewer carbon emissions than open burning or incinerating dung, practices common in developing countries. Major utility companies in Japan and South Korea, too, have indicated at coal conferences they're hungry for the U.S. commodity, Hayes added. "They told us very plainly if we build port capacity on the West Coast and we ship it, they will buy it." About 7 percent of Utah coal is currently shipped to foreign markets, so more port capacity would significantly expand that share. An eight-week study by Deloitte Consulting that spanned the United States, South America, parts of Europe, Asia, Australia and South Africa concluded that deeper penetration into international markets could provide new revenue opportunities for savvy U.S. Coal producers. While coal has traditionally been a "swing" option for excess coal, the study noted that some markets are "ripe" for expansion. The four counties hope to export about 5 million tons of coal to foreign recipients. "This extends our viability with the market," Potter said. "It gives us time to not only transition, but it gives our people hope. It provides us with a future and time for us to transition to other things. Without time to get that in place and attract those other companies, we'll all be living on the Wasatch Front." Email: [email protected] Twitter: amyjoi16

0 Comments

Leave a Reply. |

Gene HazzardDon't Be Envious of Evil Men Archives

June 2024

Categories

All

|

- Home

- Sanjiv Handa

- Gene's Blog

- Rotunda RFP

- Gene Hazzard -Keeping eyes open

- Chronology of Tagami's scheme of Private-Public Partnership with City Projects

- Another Tagami scheme - Rotunda Building deal

- Oakland Army Base

- Billboards in Oakland

- Port of Oakland

- Oakland Raiders?

-

Who is running Oakland?

- Jerry Brown

- Don Perata

- Judge Robert B. Freedman

- Jacques Barzaghi

- Gawfco Enterprises

- Deception

- Doug Bloch

-

Phil Tagami

>

- SF Business Times November 20, 2005

- Rotunda wrestling

- A conversation with Oakland developer Phil Tagami

- Audit of $91 million Fox Theater project

- Tagami Conflict

- CCIG Response to Oakland Works

- Oakland developer Phil Tagami named to state medical board

- ‘Shotgun Phil’ hits another bullseye — with governor’s help

- CleanOakland Store

- CenterPoint Properties

RSS Feed

RSS Feed